Most bankers believe in the uniqueness of their financial institutions, yet research suggests consumers of banking services associate that uniqueness with name recognition, not with unique products or services.[1] To some extent, for financial institutions, digital transformation has been primarily an effort to:

- make transacting more efficient – (a key customer demand that is table stakes),

- reduce operational costs, and

- improve security.

But – as the entire industry has reacted in the same way – those investments have done little to differentiate one financial institution from the other.

Now, if member centricity means your mission is to understand and fulfill the financial needs of your members, is the digital transformation supporting it at your credit union?

To fight product commoditization, smaller financial institutions and, in particular, credit unions can focus on furthering their understanding of member behavior and reacting appropriately to it. The smaller footprint is supposed to translate into a) greater member focus and b) an agility advantage over competitors. Is your credit union winning the battle for differentiation based on these points?

Understanding member behavior is having the ability to identify when, how, where significant changes appear in a particular demographic or member’s money flows.[2]

Because loan repayment schedules and payroll deposits are set and mostly automated, it is challenging to infer from transactions alone the behavior of most members.

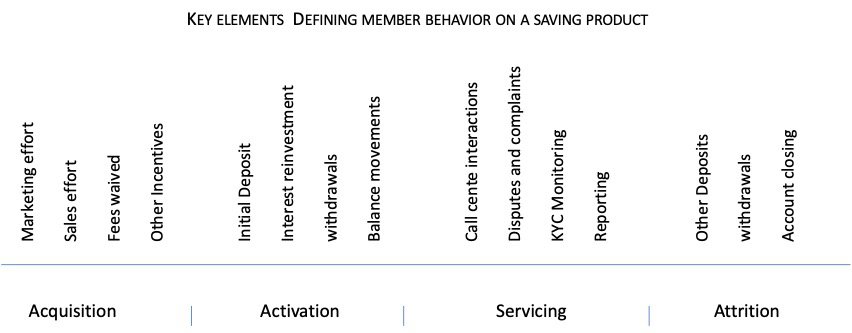

Let’s take a take closer look at a member behavior mapping in this example of the life cycle stage of a savings account – see Figure 1.

Making better decisions by understanding member behavior

Everyone agrees that allocating resources to what matters to your members is a winning formula. We believe there is also a growing consensus that the transient nature of the modern workforce and rapid adoption of electronic channels is having a huge impact on the traditional service delivery model:

- relying on the staff knowledge of individual members is increasingly difficult and unsustainable, and

- we need to enable better data-driven decisions across organizations which by design are very silo.

A real-life scenario:

“A CU grants an incentive to encourage members to migrate to Money Market accounts from 3-months CDs, in response to competitive pressures. The effort is marketed to the entire member base, and the CU allows CD withdrawals with no penalties.

After the initial deposits, some members continue to deposit funds on those new accounts while others remain flat or make some withdrawals. Forty-five days after the launch, members reach out to the Call Centre to inquire about some of the features and what is reflected in their statements. Some transactions exceed established limits and trigger KYC/AML procedures.

Five months later, some of the money for which you paid a premium starts to evaporate from those accounts. The product manager tries to determine the source of the funds, who is migrating, and what to expect next. Branches are not even aware as they do not see the accounts being closed.”

For the member, (s)he is dealing with XYZ Credit Union. Yet, internally, the behavior signals are scattered across Marketing, a branch, Call Centre, finance, KYC, among others.

Hence, you need a single source of the truth and reporting across the Credit Union to enable an understanding of member behavior holistically:

- How much New Money[3] Is the Money Market product attracting New Money?

- If we are cannibalizing the portfolio, what is the impact on my Cost of Funds?

- What are the demographics that are migrating to the new product?

- What are the demographics that are bringing New Money to the product?

- Shall it be marketed to the entire member base or are to a selected segment?

- What is the post-acquisition behavior of those who enter the product, i.e., 1-month, 2, 3, 7-months, 1-year?

- Is the product being used as planned and meeting retention expectations?

- Does the product lead to deepening the member relationship?

- Are unusual transactions the results of money flowing across existing accounts or do they require further investigation/reporting?

- What is product attrition? Expect that accounts will not be closed, the money migrates, and maintaining the account will cost you money without benefiting from the funds.

- Does it mean historical norms?

- Is the issue centered around specific demographics, regions, branches?

At many credit unions, answering all – even some – of these questions represents a time-consuming effort. It involves one or more analysts, ad-hoc data requests to IT, and spreadsheet models that do not coincide in the answers from one department to the other. A holistic view of member behavior simply does not exist.

We believe that member centricity must entail a deep understanding of members’ preferences and changing financial needs. It is time to turn the data you have into insights to decide what is happening now, what is needed, and establish a hypothesis on what can be done. Plus, test your ideas based on your historical performance. At FlowTracker, we enable you to answer all those questions at the click of the bottom.

Let us know in the comments what is your credit union doing to extend the digital transformation into a: the decision-making process and b) understanding of the members’ behavior. The conversation can propel forward many in our industry.

[1] https://www.linkedin.com/pulse/risks-brand-commoditization-what-can-banks-do-lincy-therattil/

[2] Money Flows reflect the financial decisions a member makes and reflects their needs and preferences.

[3] New Money: Money incrementally added to the member’s accounts and is not coming from an existing product.