We all faithfully gather competitor interest rates regularly to help inform pricing decisions. Is that enough?

Today, umpteen interest rate comparison sites are available to anyone with an internet connection. Your competitors are leveraging that information, and so are consumers, who are better informed today than ever.

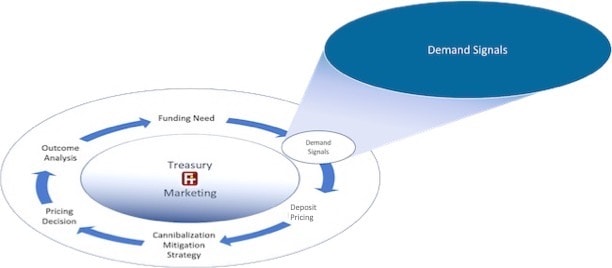

Competitors’ rates reflect market conditions and the realities and needs of their portfolios. Furthermore, it’s evident that just looking at competitor rates does little to help one achieve a competitive advantage. One also needs additional sources of information about demand. In this post, we focus on a critical element to leverage rate setting as a process to get a market advantage:

Understanding Changes in Consumers’ Needs and Preferences

To succeed, we need to understand what consumers think and feel. Not easy! Particularly when trying to understand the changes in customers’ needs and preferences proactively before they take their money elsewhere. But the right kind of analysis can go a long way. We at Flowtracker focus on providing insights into how your current customers/members behave to provide you with a sense of

- Who is doing what?

- When? and

- Where?.

The Why must be layered with supporting marketing research.

That is possible by analyzing money flows into, out of, and within each relationship over time, by product, demographic segment, and geography.

As mentioned in previous posts, Money flows are the behaviors we see when consumers make financial decisions to meet their changing needs. Therefore, we can “see” changes in term preferences and liquidity preferences which tell us:

- What is hot and what is not?

- Variances in the behavior of consumer segments and

- which market areas are giving stronger or weaker demand signals about specific terms and liquidity preferences.

Those are all powerful inputs to be incorporated into our choice pricing and marketing tactics.

This is why you need to care

If we are trying to grow deposits in a term category that consumers do not prefer, we will likely need to pay a premium to attract the funds we need. Yet, if such increases can consider the nuances of the behaviors of different segments, your marketing effort and impact on the marginal cost of funds can vary greatly. And vice versa, smaller premiums are required when demand signals show a preference for our offer.

Demand signals also inform us about liquidity preference. The movement of money between savings products, like Money Market accounts and CDs, informs us about the relative demand for liquidity versus price. Said flows can also be used to identify demand sentiment in your market concerning the expected direction interest rates will move; for example, are people parking money waiting for rates to rise?

By monitoring demand signals, competitor rates, and wholesale funding rates, you gain a more informed picture of the forces at work that you must consider when setting deposit prices.

We invite you to explore this complex topic and talk to us today.

Let us have your thoughts and become part of the active deposit management movement shaping deposit management for today’s realities.