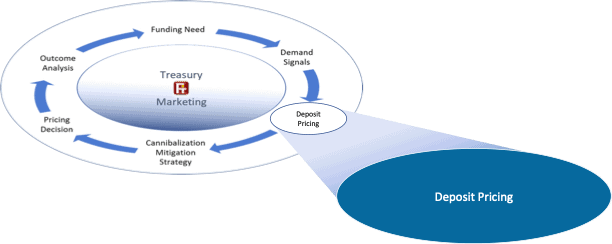

Developing a defensible point of view about the deposit pricing rates you should offer is challenging. There are many factors to consider:

- your funding needs,

- wholesale funding costs

- Deposit demand signals,

- in-market competitor rates,

- account administration and

- the net interest margin (NIM) you need to maintain healthy profitability.

In this post, we will combine these things into a defensible deposit pricing practice for the funds you need to attract or retain.

The first priority is to understand your funding needs. Your Asset-Liability Management (ALM) specialists in Treasury or Finance understand the dollar amounts and term structure of funds required to manage interest rate and liquidity risks within prescribed limits.

Once we know what funding is needed, we look to wholesale market rates to assess wholesale money’s viability as a funding alternative. We commonly refer to Federal Home Lending Bank (FHLB) or Treasury rates as reference rates for wholesale funding. Treasury rates need to be adjusted for your institution’s risk premium since Treasuries are quoted as risk-free rates. The difference between what you can get at FHLB and Treasury rates is a good proxy for this premium. If you have excess funding, Treasuries, as quoted less transaction costs, are a good proxy for market yield.

Other considerations when looking for an appropriate benchmark.

A synthetic yield curve – derived from historical rates – that considers:

- the level of rates,

- the direction they are moving in, and

- the shape of the yield curve (e.g., inverted, normal)

It can also provide a benchmark for comparison.

Reviewing the reference rate and synthetic yield curve – adjusted for your institution’s risk premium – provides a sense of the maximum rates that could be offered without incurring a negative margin. These are rate caps you should never price over (the lowest of the 3), or you will lose money on every dollar.

Next, we add the net interest margin we need to achieve our budget/plan financials. Matched maturity funds transfer pricing mechanisms determine the margin on each deposit and loan, enabling planning to estimate deposit product margin and loan product margins separately. Deducting your planned net interest margin from the reference rates results in a price that satisfies your budget expectations.

Competitors’ rates may align with your needs.

Your competitors’ rates will not necessarily align closely with your margin-adjusted prices for several reasons:

- Their funding needs may be different. They may or may not be taking market demand signals into account.

- They may have a different institutional risk premium.

- There are significant time lags between when wholesale rates rise and fall versus retail rates. For example, in a rising rate environment, competitor rates will typically be below the calculated margin-adjusted prices calculated.

How much premium to offer depends on the market demand signals you see and how much funding you want to bring in. When competitor rates are below margin-adjusted prices, you can increase the premium price and remain within budget. Conversely, when competitor rates are above margin-adjusted prices, you may have to reduce your prices to match competitors or risk erosion of your funding base.

Either way, a defensible pricing model is a good step towards developing the rate you intend to offer to meet specific funding needs.

We invite you to explore this complex topic and talk to us today.

Let us have your thoughts and become part of the active deposit management movement shaping deposit management for today’s realities.