Deposit Attrition – portfolio growth: We have had the good fortune to work with our customers, analyzing many months of products, customers, and balancing data across all deposits and loans of bank portfolios. The work has enabled us to draw conclusions about true growth, attrition, sales, cross-sales, and product substitution customer behavior with added precision. With this information, a bank or credit union can quickly assess what’s working and what’s not, and more importantly, react to changing customer behavior and market conditions.

In our last two newsletters, we looked at bank product cannibalization, with a specific focus on account attrition, product attrition, and customer attrition.

This month we will show you how looking at lost money flows gives you a far more powerful and insightful view of this pervasive customer behavior.

Deposit attrition. Credit Unions and Banks can’t afford to ignore it.

We have had the good fortune to work with our customers, analyzing many months of products, customers, and balancing data across all deposits and loans of bank portfolios. The work has enabled us to draw conclusions about true growth, attrition, sales, cross-sales, and product substitution customer behavior with added precision. With this information, a bank or credit union can quickly assess what’s working and what’s not, and more importantly, react to changing customer behavior and market conditions.

In our last two newsletters, we looked at bank product cannibalization, with a specific focus on account attrition, product attrition, and customer attrition.

This month we will show you how looking at lost money flows gives you a far more powerful and insightful view of this pervasive customer behavior.

90 % of attrition goes unreported.

The problem with using the status of the account, products, or customers to measure attrition is, it leaves nearly 90% of attrition unreported. Attrition that occurs within customer relationships, products, and accounts that are still ongoing and is the “silent killer” of deposit and investment portfolio balances.

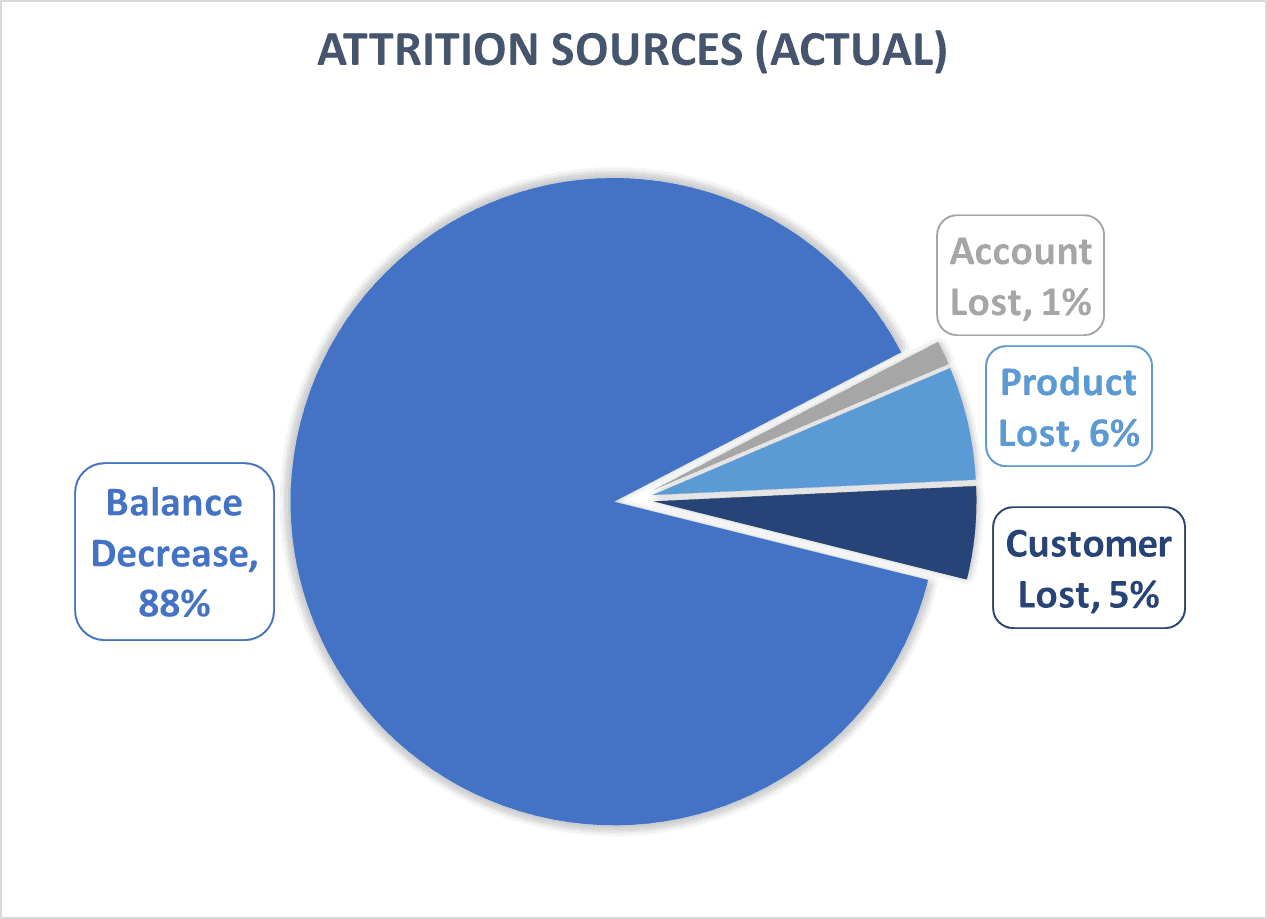

Here is a chart showing the proportion of actual balance attrition associated with lost customers, lost products (customer still active), lost accounts (customer and products still active), and balance decrease attrition in ongoing accounts in ongoing relationships. As you can see the vast majority of attrition happens within relationships that are still ongoing.

Some definitions around this significant observation will be helpful, so bear with us while we get a little technical. First, these numbers only include deposit money that has actually left the financial institution. They also exclude small amounts that fall within the normal day-to-day changes of banking relationships such as fees, interest, and small changes (defined as 80th percentile of observed balance changes for the product).

The data underlying the chart is a full year with a sample size in excess of 100,000 customers.

Customers frequently move money around

The figures above also exclude the effects of product substitution and renewal activity. In the deposits and investments space, customers frequently move money from one product to another. If you measure attrition at the total customer level, these customer insights are a non-issue, since product substitution will net to zero at the customer level – so the metrics at the customer level are 100% right, but only address 5% of the attrition issue.

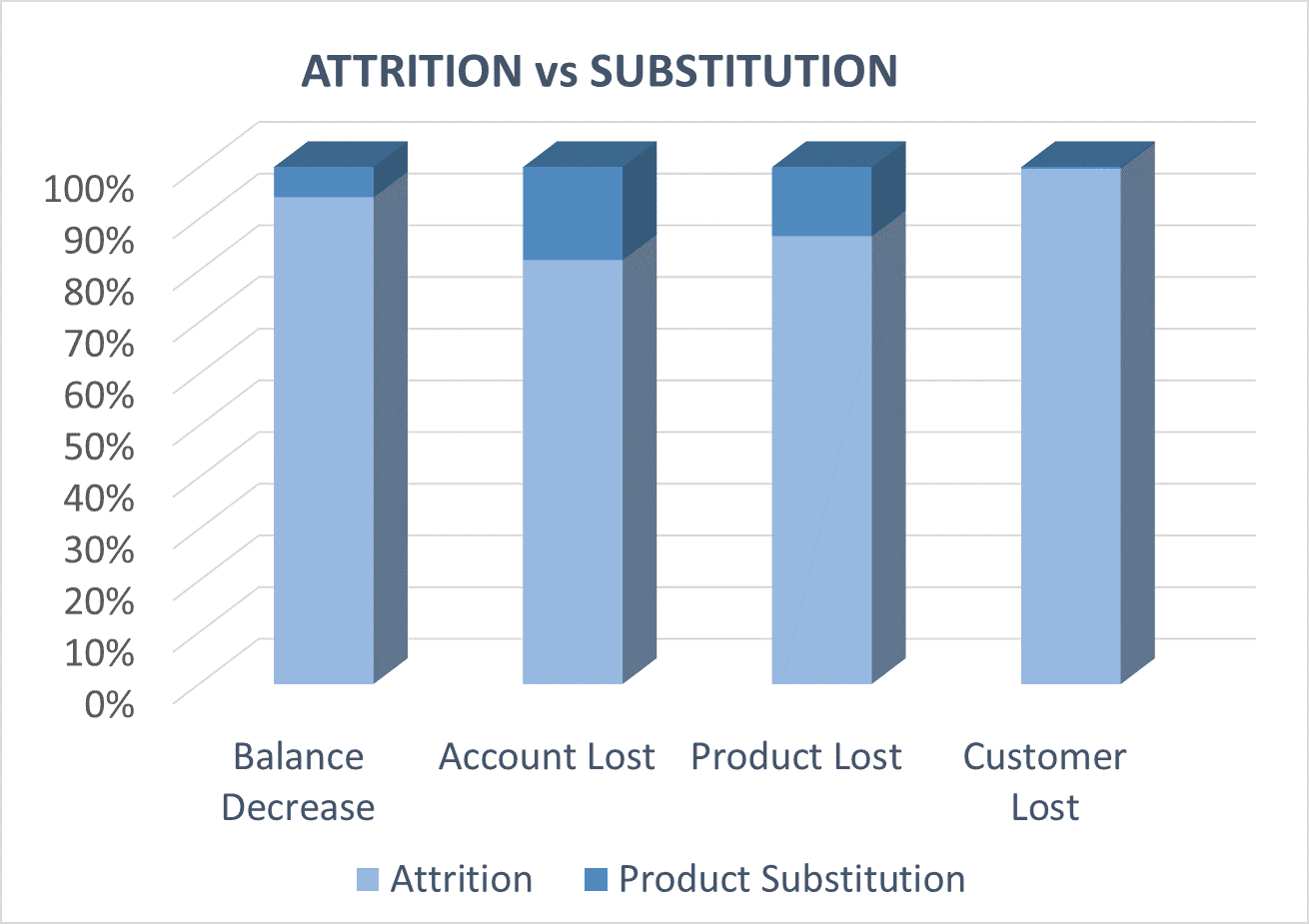

At the product and account levels, product substitution creates a very large distortion in attrition analytics, unless you exclude them. The chart below shows the proportion of total balance decreases that are accounted for by-product substitution versus lost money to the bank. Lost account metrics are inflated by 22% and lost product metrics by 15%, using the same data as the prior chart.

And that excludes account to account transfers within a product (i.e. renewals).

Two big conclusions

From this analysis, we can draw two significant conclusions about attrition analysis and measurement. First, it is essential to understand attrition in an ongoing account, product, and customer relationships because.

That’s where nearly 90% of the money lost to the institution occurs.

To do this you need to be able to separate out small, normal fluctuations in customer accounts such as fees, interest, and day-to-day variances from the significant changes that constitute true balance attrition.

Second, you need to separate out the effects of product substitution and renewals from account level changes to have an understanding of the true cash external cash flow that is real attrition.

Product substitution will distort your understanding of customer behavior as it relates to attrition by 20% or more if it isn’t separated from real lost business cashflows.

Why this matters

Why “silent attrition” matters to you

The “so what” aspect of these conclusions is that most predictive modeling and performance reporting today is not based on pure attrition cash flows, resulting in misdirected investment spend on retention and inappropriate performance measurement for this key driver of portfolio balance growth.

If you want your bank or credit union to act smarter on attrition, contact the experts at FlowTracker Analytics to learn how you can get the right metrics, measures, and analytics using just six fields of data that everyone has.

NOTE – Data reflected in the graphs depicted in this newsletter are illustrative only and do not reflect any of our current customer’s data.