Banking sales goals and strategies: Shore up the target-setting process. Regulators have also been focusing on target setting as a source of poor customer outcomes. Banks must ensure that targets are both timely and achievable. They must also avoid painting with too broad a brush: targets should be tailored to a micro-geography level. – McKinsey

McKinsey has put out a great article about the need for sales performance management reform in Banks and Credit Unions. Their suggestion of a customer-centric approach is something we agree with strongly. But how do you implement customer-centric sales performance management? We share some novel thoughts about the how-to in this post.

Balance customer and financial outcomes. Incentives should lead to positive outcomes for both the bank and its customers. – ibid.

It’s good advice – putting the customer at the center of evaluating sales performance motivates the right behavior for clients. And it is good for Banks and Credit Unions too, since deeper, more satisfactory relationships are both more profitable and less susceptible to attrition. The big question is how to do it? How do you set micro-geographic targets? What are the positive outcomes for both banks and customers that we can measure?

We did research to find out more. The charts in this post show data from a US Q42017 research study sponsored by FlowTracker Analytics in partnership with the Financial Managers Society. Content is copyright 2018 FlowTracker Analytics Inc. This study informs the discussion of the current state of sales goals and performance management in this post. Let’s start with the goals and move on to target setting later.

Sales performance goals are a complex subject. They need to be SMART – specific, measurable, attainable, realistic, and timely. They also need to be manageable, in the sense that sales managers need to identify causal factors that they can do something about, rather than just see excellent versus poor outcomes. Activity management is essential to running any sales organization because sales are in part a numbers game: if the activity is there and the value proposition and prospecting are appropriate good results will follow. This means measures like call rates, meeting counts, new customers counts, and the like need to be monitored as table stakes. But is that enough? – we think not.

Beyond activity management, which has no direct link to the benefit of sales efforts to the customer, Bank or Credit Union, you need to be able to measure successful outcomes. In our view, the goal is to grow the deposit and loan business by increasing the depth and breadth of client relationships by meeting customer needs. We think most would share that view. What are the performance metrics in Credit Unions and Banks today that attempt to forge this link? Are they good enough?

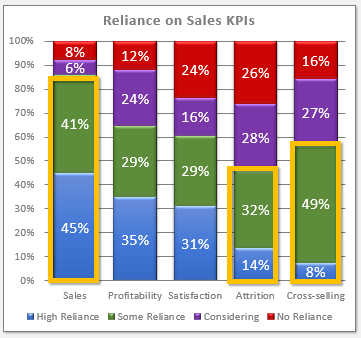

New accounts, new products, new customers as sales. By far the most frequently measured (see chart Reliance on Sales KPIs), these metrics all share one very big problem: they only work well for lending. Deposits are completely different, largely because deposit products are, in varying degrees, substitutes for one another. In real life, people use deposit products together to achieve their goals.

An enormous amount of money flows between deposit products within customer relationships inside every Credit Union or Bank every month. In other words, product substitution is something people do all the time in the deposit side of banking relationships. And the numbers are huge – our research shows 30% of all deposit account growth in CDs, Checking, Savings, and Money accounts is actually just internal transfers of funds.

These KPIs (new customers excepted) are wildly inaccurate, inflating sales, cross-sales and attrition stats by roughly 1/3. Measuring new accounts and products is very different than measuring new money sales.

Perhaps even more important is the fact that 90% of the new deposit money flowing into Credit Unions and Banks comes from your current customer/member base. Relying on new customers counts as a growth indicator matters, but it has a tiny impact on your actual growth outcomes.

Other common sales performance metrics. Our research showed profitability and satisfaction scores were runner-ups in terms of reliance. Satisfaction score metrics are obviously a good thing, no challenges there. Profitability metrics, however, can skew the sales dialogue towards the most profitable product (to the Bank or Credit Union) rather than the most suitable and beneficial product or service to meet customer needs. This “margin bias” is dangerous for many reasons, including promotion of adverse risk selection in addition to a totally Institution-centric focus in the solution discovery process that a good sales conversation embodies.

We were also surprised to see how few Credit Unions and Banks place reliance on attrition and cross-selling metrics. Attrition seems to be ignored, yet it typically runs at 10-15% (BCG) and more than half of it is manageable.

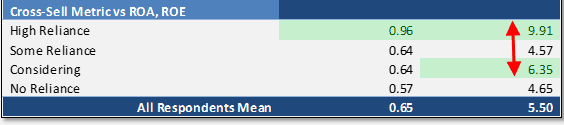

Even more stunning is the fact that only 8% of reporting Banks and Credit Unions have reliable cross-selling stats, and nearly half want to rely on it but they don’t sufficiently trust their metrics and reporting on cross-sell outcomes. This is primarily because of the problem we pointed to earlier – product substitution is a big deal in Deposits, and most Credit Unions and Banks can’t distinguish between substitution and new money when an ongoing customer acquires a new deposit product. Why is this so amazing to us? – take a look at how ROI and ROA stats for the Banks and Credit Unions that do measure cross-selling are correlated:

This is hard evidence that not only are today’s sales performance KPI metrics inadequate, improving them by adding capabilities like measuring cross-sell properly has a significant impact on performance. By the way, in case you are wondering, this finding was completely unrelated to the size of the reporting institution.

Banking sales goals and strategies should be customer-centric and micro-targeted

We fully subscribe to McKinsey’s point of view on this. And we have a solution to the problem: manage money flows instead of just counting new accounts, products, customers. The money flows we are talking about are:

- New Money Sales (including new money portion of cross-sales),

- Lost Money Attrition (including erosion of ongoing relationship balances), and

- Product Substitution (to keep it separate and distinct from new and lost money).

These money flows are what actually drive growth in Credit Unions and Banks. They also directly and accurately measure whether or not your relationships are growing or shrinking, which is the single best indicator of relationship health. When customer business is growing your profitability, satisfaction, and relationship depth all improve. Meeting customer needs results in lower attrition rates and accelerated growth of new deposit balances. in short, they measure the right things. The other amazing thing about money flows is they “automagically” reflect current market conditions, product mix, and seasonality.

One of the big drawbacks to traditional goal-setting strategies is they are often based on applying growth rates to historical balances. Percentage growth rates are “pushed down” to branches and other channels mechanically, so if you have a large book of one kind of product you get a large growth allocation. One problem here is that your balance sheet reflects years of historical acquisition and does not reflect current conditions. So if you’re a suburban branch that sold tons of mortgages 5 years ago when the neighborhood was growing, but there is no new housing growth in the area, top-down sales goals will give you impossible targets. Money flows reflect the current volumes in local markets, which is far more realistic.

Another challenge is product mix. Some branches have demographics that drive deposits naturally and others naturally favor lending. Consider a branch in a retirement haven versus one in a new housing development versus another a University campus. The first will have no problem meeting deposit targets, but lending targets will be a nightmare for them. Vice versa for the new development branch, which will have all the mortgage and car loan business it can handle. And the campus branch will be great at getting new customers, checking accounts, credit cards, and student loans, but the big-ticket loans and deposits simply aren’t going to happen there. Using a one-size-fits-all approach gives some branches targets that are too easy and others targets that are impossible. Money flows at the Product level take the product mix fully into account.

Many Banks and Credit Unions also struggle with the challenge of allocating growth targets to time periods. Banking is a highly seasonal business and this must be taken into account or goals will again be too easy in some periods and too hard in others. just because they don’t “fit” with the timing of the actual behavior of real people. Money flows broken down by period take seasonality into account, relieving stress on sales staff and clients that can result from unattainable goals.

If you use new and lost money flows by Branch, Product and Month as the basis for sales performance goal planning, you automatically achieve Micro-Targeted goals. And your goals will be SMART: Specific, Measurable, Attainable, Realistic, and Timely. That’s what’s needed to motivate staff to do the right thing.

Finally, let’s talk about customer-centricity. A lot of the problems getting press coverage of late arise from product-specific goals expressed as either balance growth or counts of accounts/products. This leads to the “product push” culture that banking clients resent, regulators fear and sale staff abhors. Your people generally want to do what is right for your customers by providing services that meet their needs, but incentives and goals all too often introduce goal-based recommendation bias into a sales dialogue. Money flow metrics help with that too. When you focus on increasing inbound new money sales and reducing outbound lost money attrition, the objective is to grow the relationship, not just sell a product. Both sales and attrition need to be measured, because then a balance is struck between retaining relationships and growing them – to achieve net sales objectives your staff have to do both, and that requires focusing on providing the right services to the right customers at the right time – regardless of which products are involved.

Net sales (new minus lost money) is the ideal goal for the quantitative side of sales performance management and incentives in Banks and Credit Unions. Coupled with thoughtfully crafted activity and satisfaction goals, a truly customer-centric, micro-targeted goal and performance management regime is very achievable.

Want to know more? Talk to us! – we know how to do this right.