Deposit growth strategies and tactics:

Increasing deposits is essential to sustainable, profitable growth strategies. In a rising rate environment that is coupled with strong economic growth achieving deposit goals is the best way to control funding costs while enabling your Bank or Credit Union to meet the lending needs of your customers and members.

We conducted a research study recently with FMS that uncovered this remarkable fact: Banks and Credit Unions with balanced growth strategies achieve nearly double the Return on Equity (ROE) of those with excess deposits or loans. So it’s pretty clear that as the economy and lending demand expands, the key to profitable growth is gathering deposits despite the contraction in market liquidity that accompanies rising rates.

Can analytics increase deposits in your Bank or Credit Union?

We conducted a research study recently with FMS that uncovered this remarkable fact: Banks and Credit Unions with balanced growth strategies achieve nearly double the Return on Equity (ROE) of those with excess deposits or loans. So it’s pretty clear that as the economy and lending demand expands, the key to profitable growth is gathering deposits despite the contraction in market liquidity that accompanies rising rates.

Acquiring new customers and members is not enough.

Acquiring new members and customers to your Financial Institution is important, but insufficient to drive the deposit growth you will need to increase – or even maintain – your market share in this growth environment. We know that only 20% of new money in deposit portfolios comes from new clients. The other 80% of your deposit and investment growth will come from the customers and members you already have relationships with. The most important implication of this fact is you can use the data you have to meet your goals, but you need to turn that data into useful, actionable information about depositor behavior in order to affect the strategies and tactics that will drive your portfolio growth.

What can we learn from the analysis of depositor behavior?

Analytics can help you achieve your Deposit growth strategies and tactics at a macro level, to increase the effectiveness of Marketing campaigns strategy, and at a micro-level, to focus sales, cross-selling, and attrition goals and rewards on deepening customer relationships and produce relevant lists of clients you should be talking to. Let’s look first at the Marketing angle.

How can Marketing use analytics for deposit growth?

Marketing has the job of designing products and services that meet customer/member needs and communicating the availability and benefits of those products and services to current and prospective clients (the goal). And Marketing is responsible for being cost-effective – the results of marketing programs must deliver positive Return on Marketing Investment (ROMI) to your Institution (the constraint). The key to achieving the goal within the constraint is to ensure that messaging, medium, and offer are aligned to the product/service needs and preferences of the consumer at the time of communication.

The importance of Timing:

To be relevant, Marketing has to make the right offer at the right time to the right prospects. How do you know what to market when? Many Banks and Credit Unions time their campaigns and offers using traditional, convention wisdom, like focusing on deposits in tax season, home lending in spring and summer, and auto lending in the late summer and fall. While it is true that these macrocycles do exist in the market, it is unlikely that you can achieve any competitive advantage with such a broad brush communications timing strategy. To get a much sharper focus – and therefore higher ROMI – from your campaigns and product launches you need to look within the macro trends and understand the behavioral patterns of depositor customers.

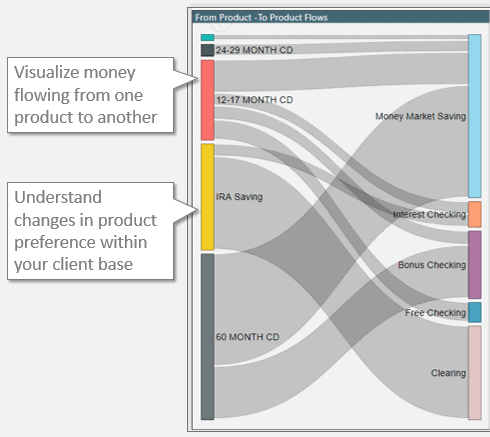

For example, let’s take the tax season, which is absolutely critical to making deposit growth goals every year. Within that macro “now’s the time” strategy, there is the best time to make each offer and message that is aligned to member/customer needs and preferences for each segment as they change over the course of the tax season. Analytics can show you the patterns of product use and how money flows from product to product over time as your customer’s investment planning decisions evolve each tax year. For example, some segments of your client base will start growing deposit balances in Savings accounts throughout the year, transferring funds to higher yield Money Market accounts in the first quarter, so they can consider their investment options before making the move to CDs or other investment products in the second quarter. Understanding the who-what-when aspects of these patterns enables you to have an empathetic and relevant dialogue with your customer at the right time. In our example there’s no point in marketing CDs in February to this group – instead, you should be ensuring their awareness of the competitive benefits of your Money Market accounts at that time, and establishing an opportunity to discuss the investment plan at a later date, which is what the member prefers. Analysis of money flows at the account level will show you these patterns in fine grain, enabling your message and offers to be far more meaningful to your customer/members.

Doing what works best

Marketing effectiveness depends on continuous learning. And to learn what really works, we have to have reliable facts. Research sponsored by The Financial Brand in 2017 discovered only 8% of financial Marketers have no difficulty measuring performance or proving results (ROI). Of the other 92%, nearly half said this was a major challenge and the rest identified it as a minor challenge. So there’s obviously a problem with enabling continuous improvement – if we can’t measure performance effectively. The good news is, this problem has been solved.

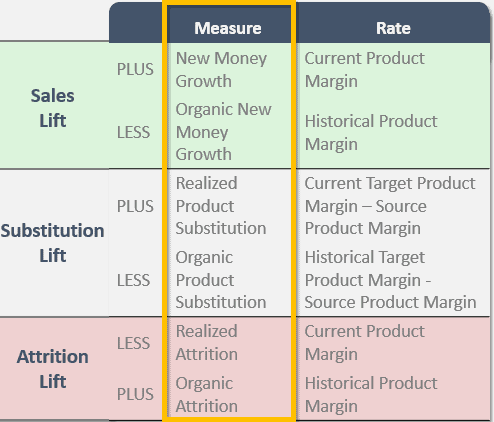

Enabling you to know what works and doesn’t work requires information in fine-grain detail about money flows into, out of, and within your Bank or Credit Union. We need to quantify new money acquisition, new money cross-sales, lost money attrition and the inter-product flows of funds that occurred as a result of our campaign, and the baselines of these flows without our campaign. Only with money flows classified as new, lost, and product substitution (product cannibalization) can we break down marketing lift into its three components – Sales Lift, Product Substitution Lift, and Attrition Lift. We need to understand product substitution by looking at which products/services were the sources of funds and the destination of funds so we can evaluate whether these cross-product flows were positive or negative on our margins when considering what we were already earning on deposit and investment money inside your Bank or Credit Union.

A great example of the impact of inter-product flows is a premium rate campaign. Nearly every Credit Union or Bank puts a “teaser-rate” or “premium rate” or some variant on that theme in-market during the first quarter. But do these campaigns create value or destroy value for your institution as a whole? The answer resides in the analysis of inter-product flows. Some of these campaigns do little more than “cannibalize” your existing deposit base, through deposit product substitution. Shifting money from existing deposits to a higher-cost premium deposit product can be destructive to funding costs as a whole, so understanding the extent and nature of product substitution is absolutely essential if you do these types of marketing activities to gather deposits. As much as 80% or even more of a premium rate campaign may be sourced internally, yet fewer than 10% of Banks and Credit Unions today have the ability to measure and understand these impacts.

With the right fact base and a test-and-learn continuous improvement process, your Credit Union or Bank can drive deposit growth far more cost-effectively. And with detailed, fact-based analysis of marketing performance, it becomes much easier to relieve Marketing budget constraints – the number one challenge reported in the above-referenced Financial Brand report. When you can prove the return on your marketing investment and your sales, attrition, and cross-sale numbers explain the total change in the balance sheet (the only proof that they’re right) your colleagues will find it easier to support the much-needed marketing investment you need to grow deposits and thereby fund loan growth profitably in today’s rising rate, expanding economic growth environment.