Improve banking analytics

We want to share some of our learning from last year with you. We were very fortunate to work with our customers through analysis of multiple months of data to enable a time series look at products, customers, and balances across all deposits and loans of bank portfolios. This helps to draw conclusions about true growth, attrition, sales, cross-sales, and product substitution customer behavior with added precision. With this information, a bank or credit union can quickly assess what’s working and what’s not, and more importantly, react to changing customer behavior and market conditions.

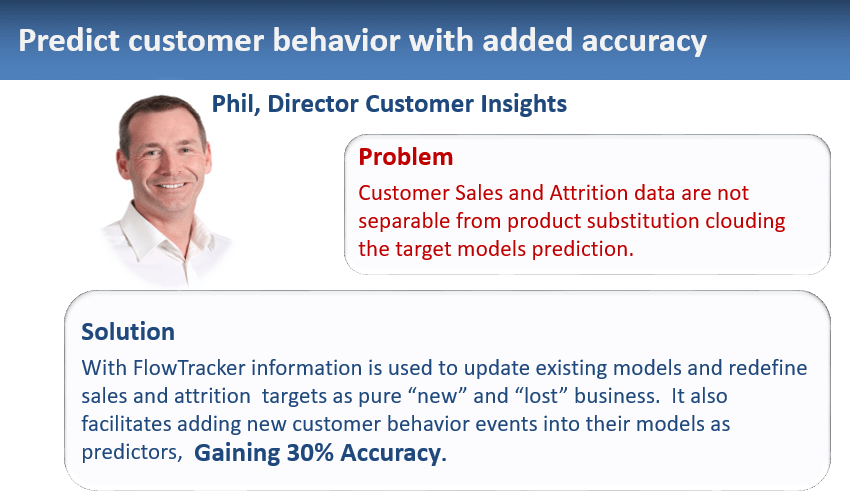

There are two novel pieces of information that Dave McNab, Banking Analytics Expert, and CEO of FlowTracker Analytics discovered during the analysis performed that I want to share with you as well as our new and improve bank analytics, capabilities to gain actionable insights into products, customers, and balances. I will bring you this insight in three parts – the first in this newsletter – and in the next two consecutive newsletters.

The first confirmed discovery is “small data can yield big insights”.

Although some organizations are investing in big data, and artificial intelligence to gain a competitive edge, we encourage exploiting data you already have access to as the first line of defense against competition.

One of the best things about customer behavior analysis is that it can be performed using “small data”: inputs that everyone in the Banking and Credit Union sector already has and requires no complex data mapping. A complete analysis of Sales, Attrition, Cross-Sales and Product Substitution customer behavior at the finest level of grain – by account – can be created from just SIX fields of data found in nearly every Marketing Customer Information File (MCIF) system – Bank ID, Branch ID, Customer ID, Account ID, Product ID, and Period End Balance. No transaction files or complex mapping of transaction codes is necessary!

Our second discovery is “we can back-fill history” quickly and efficiently.

Overcoming the challenge of generating historical time series analysis is usually a huge problem, delaying the realization of valuable insights for many months. Not so with this analysis! It is possible to back-fill the analysis historically going backward in time, period by period for as long as you have history right away. The secret to enabling the immediate implementation of history is data requirements which are limited to just the essential facts, and these facts are readily available in most MCIF system history databases: Bank ID, Branch ID, Customer ID, Account ID, Product ID, and Period End Balance.

By leveraging your access to these six data fields – ask your Marketing team or MCIF vendor – your bank can enjoy the rich, detailed, and insightful analysis of customer behavior on a historical trend basis, enabling smarter management of Sales, Attrition, and Cross Sale strategies and tactics today – no waiting for history to accumulate!

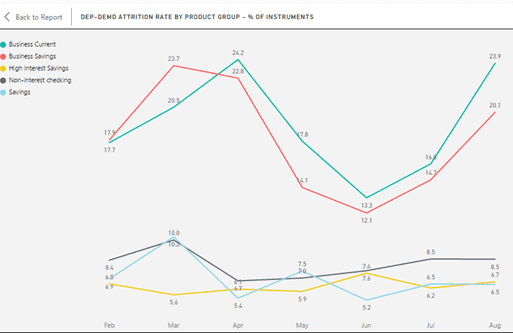

Let’s take a closer look at Attrition. Why is it a big deal?

Managing attrition is important in Financial Services because lost business is very costly to replace. Yet few banks and credit unions have mastered the measurement – let alone the management – of attrition.

We have discovered that one problem is one of the definitions. Depending on which Executive you are talking to, attrition means different things.

For example, a Customer Segment VP may be focused on retaining and growing customers, while a Product Line VP is likely more interested in knowing whether they are losing products, accounts, or balances. So, we get tangled up in attempts to define one metric that serves all masters.

As is usually the case when facing a choice between this metric OR that metric, the answer is they both have merit in the right context. As a provider of management information, you need to be responsive to the needs of Executives and recognize the fact that their needs vary even though it might mean having several different metrics for “the same thing” i.e. attrition.

The definitions we work with and recommend for attrition recognize the diversity of needs bank Executives have. The most basic metric is Account (aka Instrument or Contract level) Attrition which is most likely of interest to the Product Manager, Marketing Executives, and Branch Manager.

What is Account Attrition? – The number of accounts “lost” in the period.

How do you determine “Lost Account”?

What constitutes a “lost” account in a period, however, is not necessarily obvious. When you are dealing with accounts of products that do not have a fixed termination date e.g. credit cards, bank accounts, investment accounts, the date the account is closed might be appropriate. Or you might want to define a set of criteria that enable you to tell when the account becomes inactive.

Generally, in a bank, the date the account gets purged from the system is absolutely not the right criteria, since that tends to happen after-tax reporting is completed, usually months after the fact.

WOW! What’s Next?

Stay tuned for the next newsletter as we continue our in-depth discussion into attrition. In our next newsletter, we will be taking it to the next level – product attrition – and looking at how time series derived from small data can reveal true customer behavior trends in your financial institution.

NOTE – Data reflected in the graphs depicted in this newsletter are illustrative only and do not reflect any of our current customer’s data.