Shore up the target-setting process. Regulators have also been focusing on target setting as a source of poor customer outcomes. Banks must ensure that targets are both timely and achievable. They must also avoid painting with too broad a brush: targets should be tailored to a micro-geography level. – McKinsey

As the midyear evaluation period approaches, we are revisiting a previous post. We discussed ideas from a McKinsey article about the need to revamp some sales performance metrics in Banks and Credit Unions. Their paper endorses a customer-centric approach to performance management, something we agree with wholeheartedly. But how do you implement customer-centric sales performance management? We share our thoughts about the how-to in this post.

Back in Q42017, we conducted a research study in partnership with the Financial Managers Society. And while we researched this topic several years back, we invite you to consider if something has drastically changed how performance management is carried out at your financial institution. In this post, we leverage some of the charts from the data collected at the time.

Sales performance goals are a complex subject. They need to be SMART – specific, measurable, attainable, realistic, and timely. And sales managers need the ability to identify levers they can influence rather than count excellent versus poor outcomes. That is, Activity Management is essential to running any sales organization. Because sales are in part a numbers game, good results are likely to follow if the activities are there, and the value proposition and prospecting are appropriate. That means that measures like call rates, meeting counts, new customer counts, and the like need monitoring. But is that enough? – we think not.

In our view, the goal has to be to meet prospective and existing members‘ needs in a way that grows the depths and breadth of the customer/member relationships. In turn, that will boost the deposit and loan portfolios.

Are the performance metrics commonly used in Credit Unions and Banks today good enough?

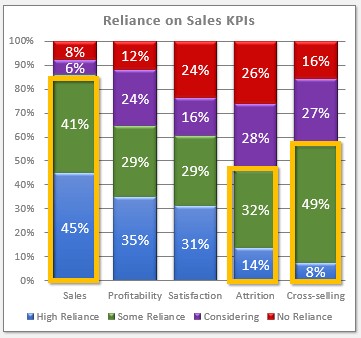

The most frequently measured sales performance metrics are New accounts, New products, and New members (NNN KPIs). These metrics share one common issue: they only work effectively for lending. Deposits are entirely different, mainly because deposit products are, in varying degrees, substitutes for one another. People use deposit products together to achieve their financial goals in real life. (See Fig. 1 – Reliance on Sales KPIs)

An enormous amount of money flows between deposit products within customer relationships inside every Credit Union or Bank every month. And the numbers are significant – our research shows that 30% of all deposit account growth in CDs, Checking, Savings, and Money accounts are just internal transfers of funds. In other words, product substitution is something people usually do on the deposit side of banking relationships.

The NNN KPIs (new members excepted) are wildly inaccurate, and the inability to measure cross-sales and attrition accurately inflates sales stats by roughly 1/3. Measuring new accounts and products is very different from measuring new money sales.

Perhaps even more important is that up to 90% of the new deposit money comes from their current customer/member base in some financial institutions. Relying on new members counts as a growth indicator matters, but it can have a limited impact on your actual growth outcomes. And why the focus on Deposits at a time of excess liquidity? Because the Deposit side of your portfolio holds the key to your relationship with your members. Understand the dynamics of that portfolio to strengthen your existing customer/member relationships.

Some performance metrics have little adoption

We also discovered that few Credit Unions and Banks rely on attrition and cross-selling for their performance metrics. Attrition seems to be ignored, yet it can run at 10-15% (BCG), and more than half of it is manageable.

Even more stunning is that only 8% of reporting Banks and Credit Unions had reliable cross-selling stats, and nearly half want to rely on it. Still, they don’t sufficiently trust their cross-sell reporting. That is primarily because of the problem we pointed to earlier – product substitution is a big deal in Deposits. Most Credit Unions and Banks can’t distinguish between substitution and new money when an ongoing customer acquires a new deposit product.

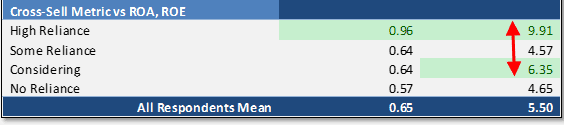

Take a look at how ROI and ROA stats for the Banks and Credit Unions that do measure cross-selling correlated.

That is hard evidence of the importance of reconsidering what is measured and why the overreliance on NNN KPIs is inadequate.

Three closing thoughts:

- If you use new and lost money flows by Branch, Product and Month as the basis for sales performance goal planning, you automatically achieve Micro-Targeted goals. And your goals will be SMART: Specific, Measurable, Attainable, Realistic, and Timely. That’s what’s needed to motivate staff to do the right thing.

- Your people generally want to do what is right for your customers by providing services that meet their needs. Still, incentives and goals often introduce goal-based recommendation bias into the sales dialogue. Money flow metrics help with that too. When you focus on increasing inbound new money sales and reducing outbound lost money attrition, the objective is to grow the relationship, not just sell a product. Both sales and attrition need to be measured because a balance is struck between retaining and growing relationships. To achieve net sales objectives, your staff has to do both, and that requires focusing on providing the right services to the right customers at the right time – regardless of which products are involved.

- Net sales (new minus lost money) is the ideal goal for the quantitative side of sales performance management and incentives in Banks and Credit Unions. Coupled with thoughtfully crafted activity and satisfaction goals, a truly customer-centric, micro-targeted goal and performance management regime is achievable.