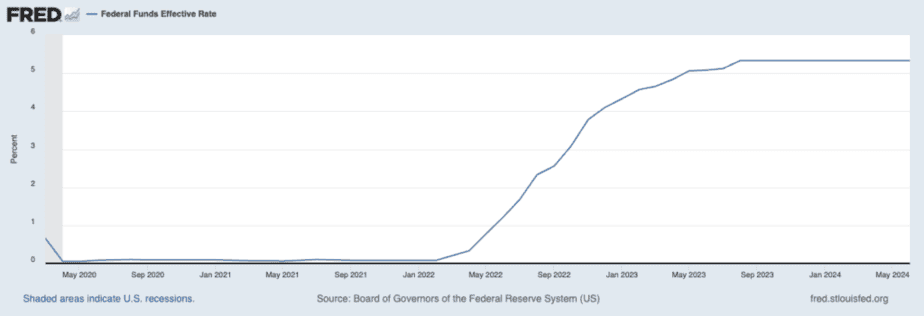

In the last two years, the Fed interest rate consistently rose from a long near-zero period to 5.25 -5.5% today, July 2024. After some recent indicators of softening in the US economy, there are renewed talks of expected rate cuts, yet nobody expects a return to anywhere near the pre-pandemic levels.

Bank and credit union customers are now accustomed to high-yield products, from higher deposit rates to money market funds alternatives. And that, combined with the stickiness of the higher cost of funds, will continue to make each internal funding dollar much more valuable. Therefore, financial institutions must continue focusing on growing deposits that do not increase their net interest expenses proportionally. In other words, understanding:

- where the funding is coming from,

- what you are giving away to get it and keep it, plus

- how long it is expected to stick around

has become mission-critical.

Do you know how FlowTracker helps other financial institutions with those tasks? It is time to manage your deposits actively as if your profitability depended on them.