Every Credit Union and Bank has a different balance sheet scenario and funding needs that require a unique response. Yet, many take a passive approach to pricing and marketing deposit funds, primarily responding to competitor offers and rates. Does this make sense?

The rise of Asset & Liability Management (ALM)

Rate shocks in the 1980s wiped out the entire Savings & Loan industry because they got caught in an interest rate trap: deposit funds repriced faster than loans in a rapidly rising interest rate environment. Asset and Liability Management (ALM) was developed in response to measure and model how gaps in term to reprice and term to maturity across the balance sheet impact capital, liquidity, and profitability under different scenarios. ALM improved management’s understanding of these risks dramatically.

Different Balance Sheet, Different Funding Needs

Funding needs can vary widely across Financial Institutions (FIs). The array of products offered, regional and community demographics, and even the unique demographics of the individual Credit Union or Bank’s customer/member base all contribute to variability across industry balance sheets. Consequently, at any point in time, the funding needs of one institution can be quite different than those of another. For example, Indirect Lending in the Credit Union industry has been enormously successful. These fixed-price loans with typical durations in the 3-4 year range make up a large part of the fixed-rate funding requirements for many CUs. On the other hand, community, Regional, and National Banks tend to have had far less success in this area. Their funding needs are simply not comparable.

Different Funding Needs, Different Tactics

If funding needs vary across FI’s in a market area, shouldn’t they each pursue different pricing and marketing tactics? Of course, they should. Yet many Credit Unions and Banks still set deposit pricing, offers, and marketing campaigns in response to competitor offers. Passively “following the leader” can be an expensive mistake, adding as much as 10-15 basis points in excess cost of funds to the deposit portfolio.

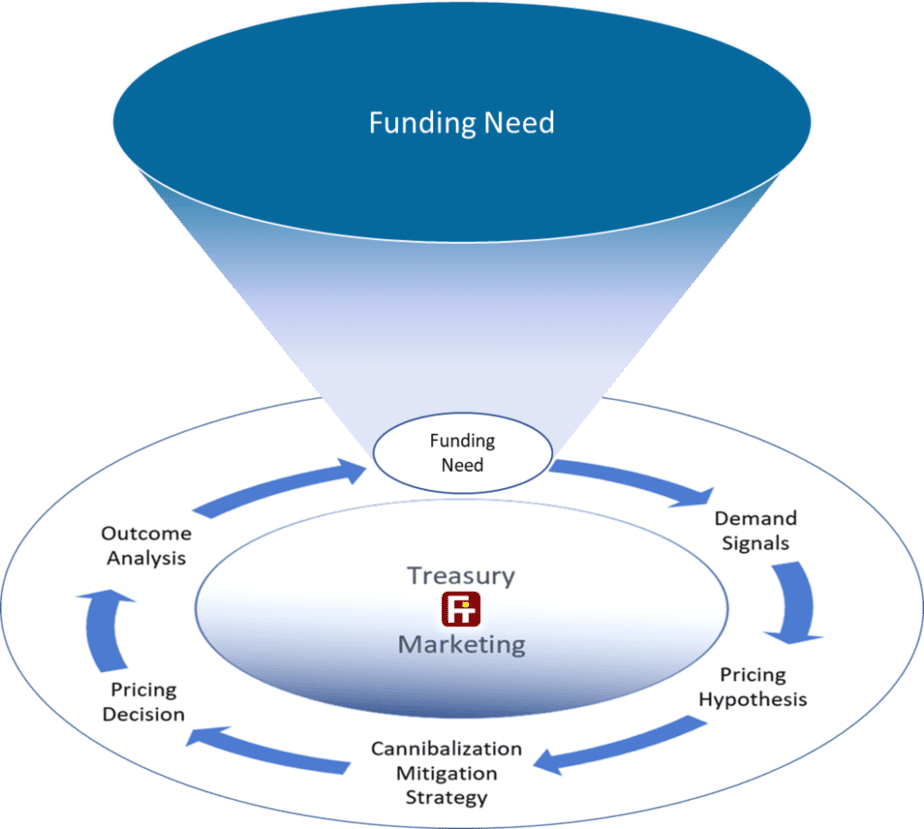

Active Deposit Management: The Solution

Active Deposit Management means actively optimizing deposit-gathering tactics to attract the funding your institution needs, minimizing the cost of those funds, and improving the quality and stability of your deposit portfolio to fuel long-term profitable growth.

We invite you to explore this complex topic and talk to us today.

Let us have your thoughts and become part of the active deposit management movement shaping deposit management for today’s realities.