At some level, in the last two years, two ideas have been central to the message in all our presentations to marketing teams:

- understanding customer/member behavior is – and increasingly will be – the key to remain relevant to your customers/members, and

- bankers must rely more on their data to guide all their actions or data helps you be a better banker.

This article explores how that translates into two challenges faced today by many Credit Unions and Banks.

- improving the member/customer experience, and

- increasing (or at least maintaining) their share of wallet of members/customers.

Data and the member experience

When bankers talk about member experience, mostly they talk about: ease of transacting; the availability of chat windows; AI features; and even speed to complete loan applications in their sites and apps. Rightfully so, as those are the bare minimums expected and demanded by today’s tech-savvy consumers. In addition, the pandemic crisis made those expectations of Gen Z and Millennials also the expectations of Gen X and even most Boomers. Add the myriad of ever-expanding digital challengers who offer ease of transacting as a fundamental value proposition, and we can see why those expenses were unavoidable.

Yet, is that investment translating into a competitive advantage today? You have those capabilities and so do your competitors – they’re table stakes, not competitive advantages. With the leveling of the playing field, that elusive competitive advantage is more likely to go to those who leverage data and turn it into:

- insights on what members/customers want,

- predictions on what they will want, and presenting them relevant financial solutions: not just product, but solutions they need to improve their financial -well-being, and

- improvements in the timing of when they proactively approach members/customers.

What is a marketer to do?

Traditional segmentation, based on demographics and psychographics, needs to be layered with the distribution of how those segments use your product and services. Understand what your members/customers were trying to achieve, as it is likely that others in the same segment will have the exact same needs. In other words, back your understanding of the persona of your members/customers with insights derived from the data you already have.

Data-driven Cross-Selling

If it is true that we mainly measure the things we care about, bankers have some way to go to focus more on the lower hanging fruit of better cross-selling. At least by the strict definition of cross-selling as:

“Selling a complementary product in the member/customer’s portfolio that attracts money not already inside the financial institution.”

In other words, cross-selling is a function of attracting New Money. Which is the critical aspect of any successful banking operation, not just placing new products. That cross-selling typically starts at the product development stage, and it s monitored through disciplined analysis of each new member/customer’s onboarding behavior. There is evidence that the industry is beginning to be more disciplined around cross-selling. Earlier this year, Accenture reported that 48% of CFOs are prioritizing product and service development. [1]

Also, think of cross-selling as a way of closing the back door to secure the hard work you did or the margin you sacrificed to acquire the relationship. The current low-interest rates and the uncertainty of the post-pandemic economic environment are driving members/customers to strive – more than before – to ensure they get the best possible terms, rates, and structures. Today a member/customer could desert you for little incentive. Therefore, the focus on cross-selling must be all-in.

If you want sustainable growth in a mature market, you must scour your data for signs that enable you to approach the customer promptly and proactively. The challenge that the data is dispersed across multiple systems and your analyses work primarily in product silos is not unsurpassable – if that is a concern for you, please come and talk to us. The key is to look at your liability portfolio as a fundamental source of information of members’ behaviors that can be mined to increase your share of wallet.

How would that work in the real world?

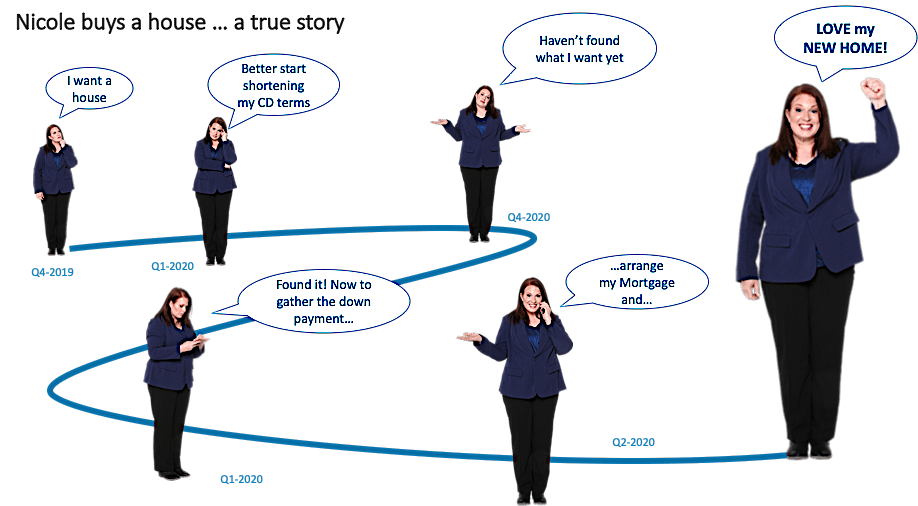

The following is a whole story in 3 images to make our message of Data-driven Cross-Selling more tangible.

Ask yourself, at what point of that cycle your institution would have been able to start a conversation with Nicole.

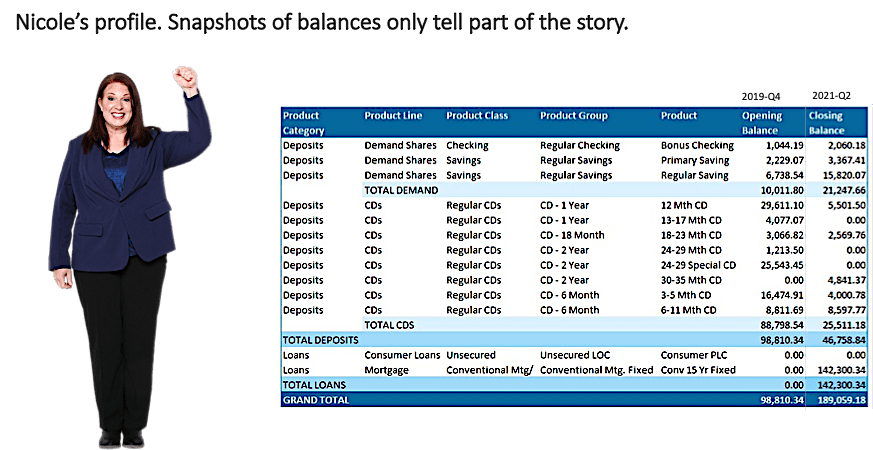

Ok, let’s look at her portfolio. Now consider what would have been the trigger to let you know there could be a business opportunity on the horizon.

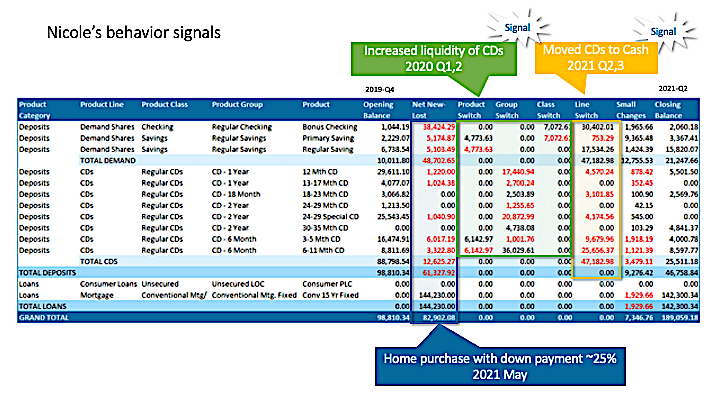

Hence the importance of analytics to turn the data you have into actionable insights that:

- helps you increase your share of wallet of the members/customers you have,

- ringfences your existing relationships from your competitors, and

- identifies business opportunities before you are forced to enter into competitive situations.

If you are experiencing challenges leveraging data to improve the member/customer experience and increase your share of wallet of the relationships you work so hard to acquire, we can help. We’d love to hear from you!

[1] https://www.accenture.com/us-en/insights/banking/bank-cfos-lead-digital-transformation