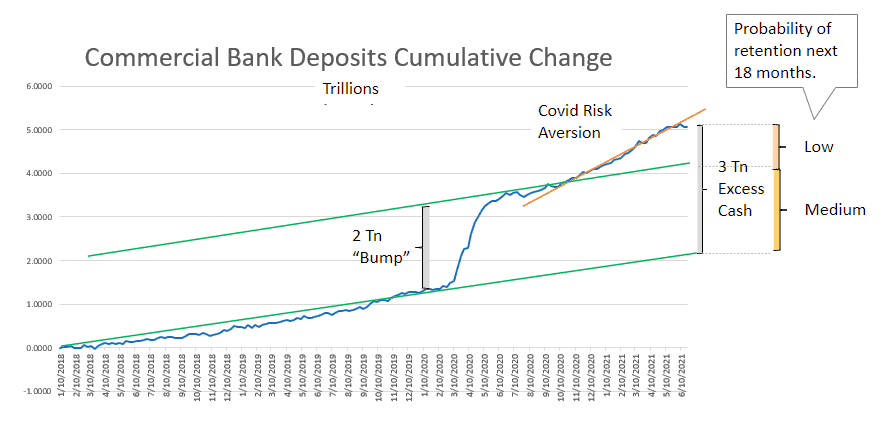

Back in March this year, we talked about what you should be doing around the COVID funds bonanza. We highlighted that Americans had suddenly become savers at record levels during the pandemic – by Apr 2020, saving rates had increased by 33.7%, and by Dec 2020, consumers had committed an additional 13.7%. We also remarked that the money was sitting in Demand Deposit Accounts (DDA) at Credit Union and Banks, creating both opportunity and headaches for those who monitor profitability – see figure 1

The question is, what have you done about it?

Yes, as the economy goes full steam ahead and the employment market is not only recovering but getting tight, in some markets, Americans are returning to more typical saving patterns. In other words, if your institution’s patterns match what we see in the data we process, the excess liquidity is disappearing fast. And while excess cash has its headaches, the excessive loan/deposits ratios that many credit unions exhibited before the crisis were not good business practices. It puts unnecessary risks into the system and limits the value you can deliver to your members. That is because it hinders your flexibility to lend competitively and take full advantage of the lending opportunities in a hot economy.

Not all DDA are equal, and if you accurately measure the money in motion within your portfolio, you will know where to start. We want to repeat some of the ideas we previously presented at the risk of repeating ourselves, so you take advantage of any current potential liquidity surplus before it is too late.

Using Liquidity to Advantage

We expect you will actively look at your reserves and your exposure based on your market dynamics, member/customer base, and industry exposure. That is a good thing.

While most economists consider inflation under control, yr./yr., inflation was up 5% in May, and former treasury secretary Lawrence H. Summers wrote in the Washington Post that “The primary risk to the U.S. economy is overheating — and inflation.” So, rates are not going up tomorrow but don’t be caught off guard if rates start to creep up. The federal government seems to have an endless appetite for stimulating the economy, and something has to give. The lower cost your deposit structure has, the better your market advantage.

Start by understanding the money flows inside your institution and monitor all deviations from your liquidity/funding plan. For example, deposit cannibalization is enormous; usually, about 30% of all observed deposit balance growth is funded by internal money flows. If rates change, depositors will seek higher yields, potentially impacting your portfolio term structure.

And yet, your members do not always need to trade-off yield and liquidity that corners you in the process. Hybrid offerings like debit-only savings accounts, in which depositors that qualify can earn yields equivalent to term deposit yields without locking up their money, are amongst today’s best in breed offers. That promotes loyalty and retention.

Now, can you afford not to know whose funds you want to retain and to which members you should offer such products? What if you only end up increasing your cost of funds by just attracting funds already in your portfolio? If knowing what members are doing with their cash takes you more than a few clicks, you will likely leave money on the table that you can use to grow or deliver benefits to your members.

Double down on investing in your members’/customers’ financial health.

Customer experience is not just how many clicks it takes to complete a transaction. You will recall that part of the reason your members/customers parked the money in DDA accounts was the sense of insecurity about the future. You can help them feel more secure and better prepared for the future. Isn’t that part of the credit union’s mandate to begin with?

Consider segmenting your members based on their behavior. Identify your members’ behavior differences by segment and branch, even the variances among products. You may be surprised what you will learn about them, but most importantly, use the information to present solutions that match their financial needs. Do that in particular for those who have above-average balances where you may want to secure and maximize the relationship’s potential by helping them prepare for a better future. By adopting a consultative approach tailored to the needs of those members/customers, you will avoid the trap of competing solely on rates. Remember that large banks were particularly good at siphoning money away from smaller players before the recent pandemic and driving away some of your best members/customers. If you are not going to leverage your data to make sure you keep the best, others will take care of their financial needs for you. It is that simple.

Be ready to take full advantage of lending opportunities

Consider using the extra liquidity to become a lending machine. There will be an increased demand for loans of all sorts during the recovery. Start by identifying money at the risk of exiting your credit union/community bank and turn that into a conversation to solve financing requirements in a manner that creates assets for you. You now have the funds to be even more competitive in your lending. Take full advantage of the insights into member behavior to maintain the funds and increase lending on a more advantageous risk profile.

Remember, every conversation can be a holistic financial needs opportunity if you understand the member in front of you. Leverage your data to ensure you are working smart, not just hard.

Not sure how to do it? That is a conversation we are happy to have with you.

We know it sometimes takes a village, so count on us to help you with these and other business challenges based on leveraging your flow of funds/money in motion information to know the right actions to take. It is time your data delivers works as hard as you do to help you succeed.