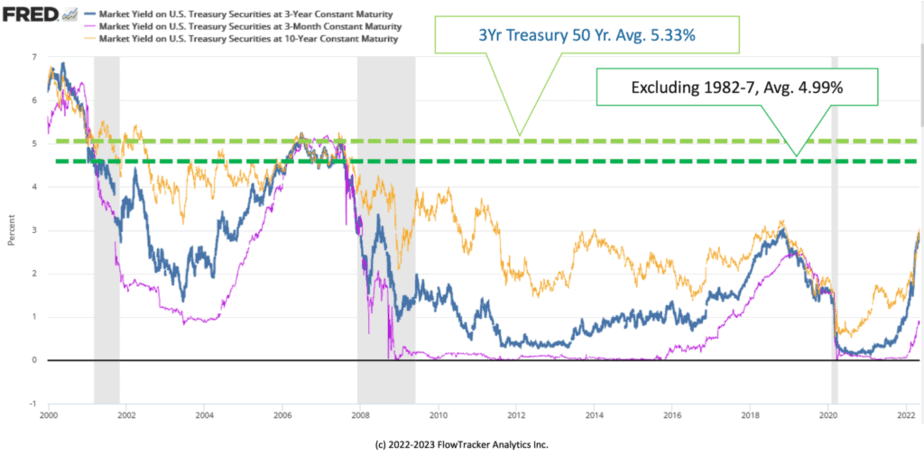

After years of artificially low interest rates, the Fed interest rates hikes are inching the market closer to its historical average. And notwithstanding the expectation of where rates will be at the end of Q2’2023, the current rate (4.32% as of Jan 13, 2023) is still below the historical 20-year average. Therefore in this article, we will explore ideas on how to capitalize on the higher interest rates through Active Deposit Management.

Over the last 15 years, we came to accept that the rate and macroeconomic environment we have operated in since the 2008 Great Recession was the new normal. Yet, that normal is now disrupted.

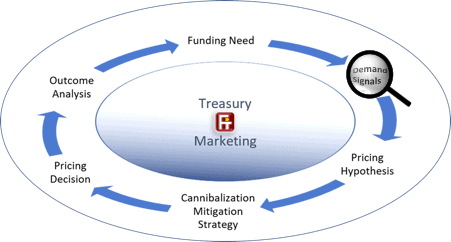

Considering our changed environment, it may be time to question the validity of some aspects of your predictive models, including how you identify changes in the behaviors, preferences, needs, and expectations of your members/customers. And that leads us to explore the Identify Demand Signal component of our Active Deposit Management (ADM) Framework.

Active Deposit Management: a tool to Understand the Demand Signals and Build Relationships

As a banker, you understand that money in motion is the behavior we see when members/customers make financial decisions to meet their changing needs and preferences. Those are what bankers call Demand Signals. And together, they form the basis on which relationship-driven organizations build programs, products, services, and marketing programs.

Dashboards & Windows – When Managing Deposits

Over-reliance on “flying by the dashboard” when the dials might be wrong can be dangerous: in times like these, it’s important to “look out the window” to see what is really happening. Even the most carefully crafted next-best product model may not serve you well today as consumer behavior patterns have changed.

More than ever, you need to understand, for example, when customers start to migrate to a given product and whether the migration can be pinpointed to specific demographics, tenor groups, or geographical areas. You must do that proactively to retain and grow the hard-won relationships in your credit union/bank.

Also, being relationship-driven means your primary focus is on addressing your members’/customers’ stated and implied needs. Yet, with increased competition and the rise of no-touch channels, it’s harder today to know customers’ wants and needs with time to react proactively. But demand signals are available if you can observe the behaviors of your members/customers. The ADM Framework aims to help you continue doing what you do better. In straightforward, efficient, and effective ways.

What would you do differently if you understood the changes in customers/members behaviors?

Knowledge is power, says the adage. Once you understand Demand Signals, you can use the insights to inform your tactics to address members/customers who are:

- More likely to bring you New Money at a time when market turmoil and some alternative investments are less appealing.

- “Rate Sharks” so you can make decisions to ringfence surge money.

- Candidates to deepen their relationship with you and become future borrowers.

- Older and may need safety and therefore receptive to more complex or value-added deposit services

- Candidates to transfer wealth and will allow you to work with them to bring the beneficiaries onto your services

These are just some of the ways reading demand signals can help inform your marketing and finance strategies.

Summary

To capitalize on the higher interest rates with Active Deposit Management, you must start by understanding the dynamics of your deposit portfolio. That is understanding your members/customers better. They need liquidity, security, returns, capital, and all that is reflected in how they manage their deposit accounts. Some bankers believe that a member/customer’s adherence to services like direct deposits and/or automatic payments gives them security in the upcoming war for deposits. But Regulation D eliminated the limits on the funds that can be withdrawn each month. Funds are now more unrestricted to travel than ever. If you don’t spend time trying to understand their changing preferences, needs, and expectations proactively, you may find yourself paying higher to replace the funds your competitors will take.

We invite you to explore this complex topic and talk to us today.

Let us have your thoughts and become part of the active deposit management movement shaping deposit management for today’s realities.