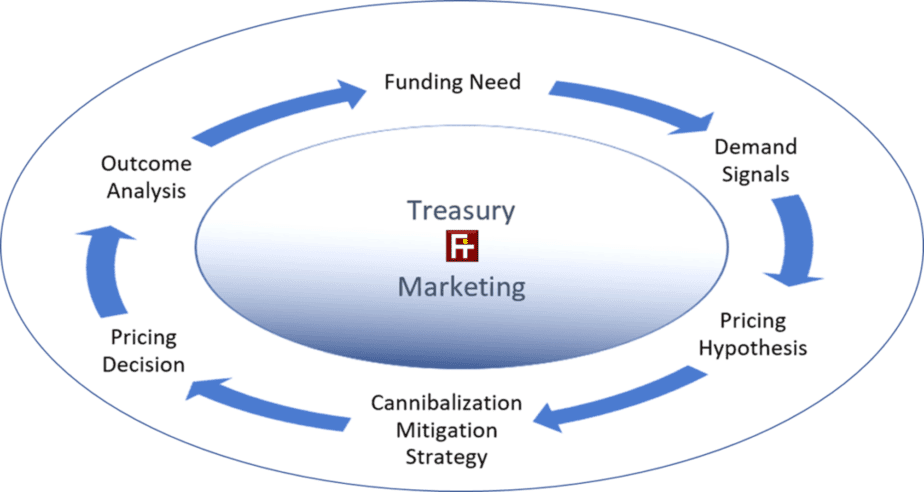

An Active Deposit Management Strategy means actively optimizing deposit-gathering tactics to attract the funding your institution needs, minimizing the cost of those funds, and improving the quality and stability of your deposit portfolio to fuel long-term profitable growth.

Let’s unpack that a little.

Many Credit Unions and Banks today still set rates by matching or bettering competitor rates and promoting premium offers to everyone in their market area. This “passive” deposit management strategy produces sub-optimal results, typically 10-15 basis points in excess cost of funds. How?

First, matching rates is a follow-the-leader strategy. You’re always responding to competitors, one step behind. The branding opportunity to be recognized as a value leader in your market – a huge opportunity – is lost.

Second, your competitors are setting rates based on their balance sheet funding and liquidity needs – which can differ greatly from yours. Following the leader can result in deposit gathering that is misaligned with your unique funding needs.

Third, extending the same offering to everyone in your market can lead to excessive cannibalization costs and hot money in your portfolio. Cannibalization rates vary widely – from as little as 20% to over 80% – when a premium rate offering is in-market. Repricing deposit money already on your books can (and frequently does) negate the value of an entire marketing campaign. At the same time, attracting “rate sharks” who are just seeking high yield lowers the quality and stability of your deposit portfolio, which increases liquidity requirements and cost.

Summarizing the rationale for an Active Deposit Management Strategy

An Active Deposit Management Strategy addresses all these problems, enabling you to continuously optimize the quality and cost of your deposit portfolio.

We invite you to explore this complex topic and talk to us today.

Let us have your thoughts and become part of the active deposit management movement shaping deposit management for today’s realities.