Stable Deposit Funding Enables Profitable Growth

- Are you able to react to demand signals revealed by changes in member behavior?

- Are you optimizing pricing strategy to minimize cannibalization costs?

- Are you actively managing renewal strategy to focus on core member growth?

Active Deposit Management (ADM) reduces interest cost by 10-20 basis points while simultaneously building and growing the foundational relationships your Credit Union or Bank needs for sustainable, profitable growth.

The Deposits Tide has Turned

For the last few years, our industry was flooded with deposits in consequence of several factors: interest rates at near-zero levels, governmental COVID relief funding and hoarding of cash by both consumers and businesses driven by uncertain conditions. Many Credit Unions and Banks experienced excess deposits on their balance sheets. Managing pricing and marketing of deposits was not a priority and a passive approach to managing deposits became the norm.

That All Changed This Year

Interest rates have spiked. When 1 Year Treasury yields are less than 1.5% and the yield curve is flat, savers are insensitive to deposit rates. We passed that threshold many months ago, and the market is now increasingly rate driven. And there’s more to come, as rates are just approaching long term historical norms.

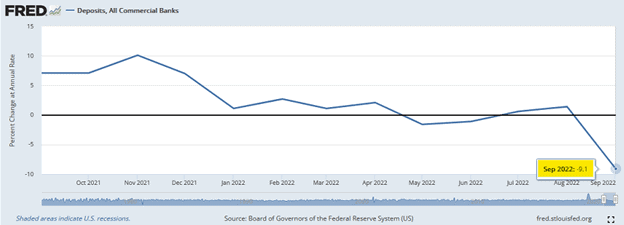

Excess liquidity is drying up. Last November we predicted a reverse of the deposits surge, unfolding over the 2022-23 time frame in two waves: a reversal of the abnormally high savings growth rate and an ebb tide of COVID relief programs surge deposits. In September 2022, savings dropped at a 9.1% annualized rate according to the St. Louis Federal Reserve. That’s big news.

Loan to Share (Deposit) ratios have trended up sharply in the last two quarters, as loan growth has outstripped deposit growth by a wide margin. At the same time Credit Unions and Banks who have significant fixed rate loan portfolios funded by demand deposits have experienced significant spread compression as floating rates have spiked. Rate competition for savings, money market and certificates of deposits has only just begun.

Passive Deposit Management Strategies are Not an Option.

Many Credit Unions and Community Banks still manage deposits passively, matching their prices to local area competitors, promoting special rate offers to everyone they can reach and borrowing from Federal Home Loan Banks when needed.

- Peer price matching fails to consider the funding needs of your institution.

- Mass offers attract “hot money” and transactional relationships.

- FHLB funding is a far more expensive than retail consumer bank deposits.

These are inefficient, expensive strategies that limit growth, reduce profitability, and do little to foster growth of deep, lasting relationships with Members / Clients.

Active Deposit Management is the Key to Healthy Growth

With Active Deposit Management you can:

- Actively build loyal member relationships by detecting and reacting to demand signals

- Optimize and validate key pricing and promotion decisions (micro market & monitor outcomes)

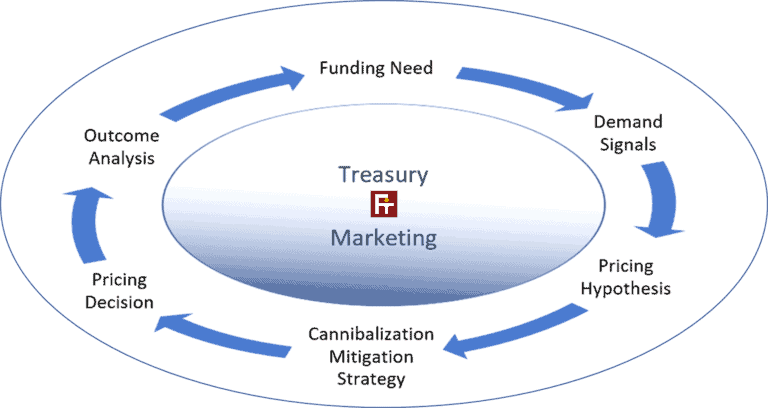

Market Signals.

Shifting term preferences and the velocity of new, lost and money flows within your own portfolio are signal intelligence that reveal pricing opportunities and risks.

By monitoring and reacting to these signals you can actively optimize the rates you offer across deposit products by identifying where premium pricing and discount opportunities exist within consumer demand.

Targeting Relationship Growth.

Offering the same pricing to everyone is an outdated strategy. Hot money attracted by premium pricing is detrimental to the value of your Credit Union or Bank.

Active Deposit Management identifies who in your Member / Client base “fits” your target persona, enabling you to use your offers strategically to establish, grow and retain high quality relationships.

Cannibalization Mitigation.

As much as 80% or more of balance growth in a Certificate of Deposit with a promotional rate offer comes from Money Market, Savings, and CD balances you already have on deposit.

By knowing which products are vulnerable to cannibalization, how much product switching is expected, which Members / Clients to monitor, and the projected cost of funds impact your can optimize pricing across your deposit product portfolio.

Outcome Analysis.

Active Deposit Management means acting responsively to ever-changing conditions.

Having the ability to monitor new money, lost money and internal flows enables you to know when to turn premium prices on and off and course-correct when results vary from expectations.

Active Deposit Management can reduce your interest cost by 10-20 basis points while simultaneously building and growing the foundational relationships your Credit Union or Bank needs for sustainable, profitable growth.

Talk to us to learn more.

Suggested Resources: