If you read this newsletter, you know about the impact of rising interest rates on the banking industry. While credit unions did not experience the failures of some of their bank counterparts, no one was immune to the aftershock those failures created. Consequently, everyone will likely experience similar banking changing priorities starting in the second part of this year.

This article explores three banking industry shifting priorities and ideas on how to respond to them.

Renewing the focus on resiliency

Inflation has been more stubborn than anticipated, and while fears of recession have receded, consumers and bankers are still cautious.

For banks and credit unions, an essential aspect of improving resiliency is controlling deposit outflows to stabilize funding costs. That goes beyond knowing if a product’s balances are up or down. It requires a dynamic understanding of how the balances happened. E.g., sources of New/Lost Money in your portfolio with enough granularity that you do not need to guess and can make informed decisions.

For consumers, that is increasingly not just using banks and credit unions as custodians of funds but as trusted advisors. At all levels, they expect advice and product innovation to help them achieve their financial goals. Every financial institution claims that is something they will strive to do for clients because they understand that their client’s financial health can add benefits to their bottom line.

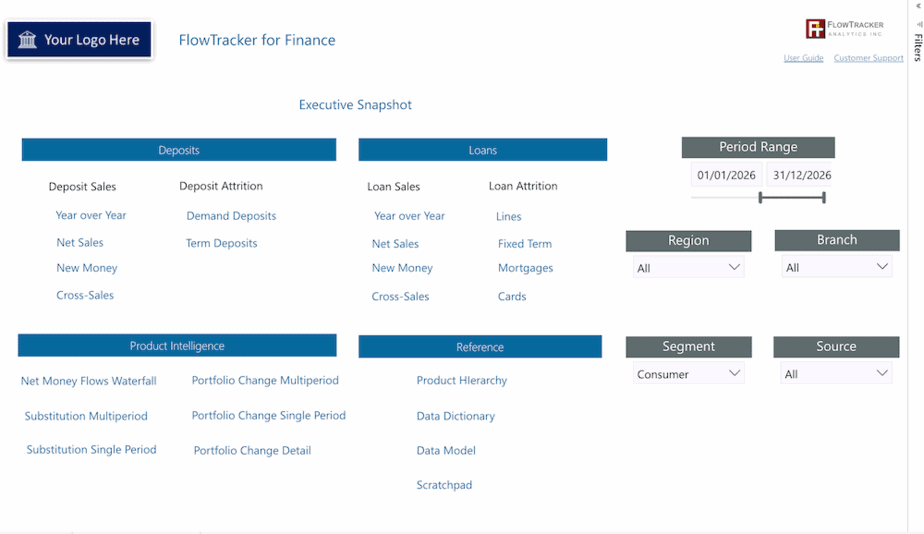

At FlowTracker, we help financial institutions deliver on both fronts consistently and methodically. They are first uncovering how money flows through their customers’ accounts – see Fig. 1. In other words, we help them understand how customers use the funds they keep at their institutions. That is a stark contrast with the typical analysis based on transactions that reflect primarily how financial institutions account for what they do.

Addressing the talent shortfall

During a session – at an important Credit Union industry event in Washington, DC, early this year – when the topic of the need to improve deposit management in the industry, someone asked who in the panel was an expert in deposits. The answer – nobody. Everyone had agreed on the need to do better, yet no one had done much about it.

This scenario is repeated at many banks and credit unions. Because, to date, priorities were different, it is easy to find experts in AML, digital, lending, and other credit products. But when it comes to deposits, skilled bankers are harder to find, and their skills inside the institutions have atrophied over the years. Since 2008, rates have only declined, and deposit management has been quite different. Furthermore, incumbents work with models and paradigms that do not fit a rising rate environment.

Due to demographic changes, the industry is increasingly transient. Even if an employee remains at your institution, only expect them to retain a role briefly. Therefore, the need to harden deposit management to the point that regardless of who is tasked, they will be able to understand what is happening, design products, or make decisions is today more important than ever. And not just because of the interest rate hikes, but because it makes for better banking and the dutiful compliance with fiduciary responsibilities. The FlowTracker Solution helps clients become more proficient at doing what they want. We help them become Deposit Champions.

Making better use of the available Data and adopting more Analytics

We remember that just a few years ago, all the talk was about Big Data. Many messiahs talked about leveraging technology to scan sentiment and influence buying decisions. Privacy regulations and ethics around using some information collected dampen many of those efforts. One positive in this is that today, most bankers see data as a raw material that needs mining to take their activities to the next level.

But consistently, we asked bankers – How are you taking advantage of the data you already have?

FlowTracker processes a few data fields using advanced analytics and generates account-level insights on New/Loss Money and Product Substitution. Information bankers can act directly or use it to address their members’/customers’ needs and improve their predictive models. At times of economic turbulence, this capability will become more valuable.

The only two significant roadblocks we observe to achieving the benefit from adoption arise from the following:

Some Institutions have a predilection for in-house-built solutions.

Said in-house solutions tend to be spreadsheet models that require significant data manipulation, need to be more scalable, burden internal resources, and are not enterprise-level solutions. They are resulting in different areas having their version of the truth. This roadblock persists even when it is understood that collaboration with third-party solution providers can help the institution accelerate value creation.

Information silos:

More than having the data and the insights available to an institution is required. The architecture of most financial institutions sometimes needs to be more conducive to sharing information and even best practices. To maximize value realization, data and insights need to be democratized throughout the bank/credit union departments and, hopefully, all the way to customer-facing employees who can use it to improve member/customer experiences and engagement.

In fairness, the lack of analytical skills in some areas of the organization can hinder, at times, the democratization of information. Creating centers of excellence that serve multiple functional areas can be an interim solution. At the same time, the bench strength of said skills must be allowed to grow. But make no mistake, the same way that understanding Excel was considered a skill years ago, analytical skills will be increasingly common as technology takes hold of the industry. The board and senior management must determine how they want this to play inside their organizations.

We recommend organizational culture evaluation and change management work to eliminate this roadblock.