Practical ideas to help deposits: Increasing deposits is essential to sustainable profitable growth strategies. In a rising environment that is coupled with strong economic growth, achieving deposit goals is the best way to control funding costs while enabling your Bank or Credit Union to meet the lending needs of your customers and members. We continue to give guidance to the Credit Union and Banking industry in strategies to help grow deposits by looking at the sales side in this article.

Hint: Look at your processes and engage your people!

Look for untapped deposit growth opportunities inside your own portfolio.

The combination of reliance on indirect lenders to grow assets and increased use of alternate delivery channels has created an environment in which branch staff has limited contact and insight into some of the most profitable relationships in their Financial Institution. But the flip side of every problem is an opportunity…

In this case, the opportunity comes from enabling branches to proactively pursue business from under-served customers. After all, research indicates that the probability of selling to an existing customer is 60-70% vs 5-20% for new prospects.

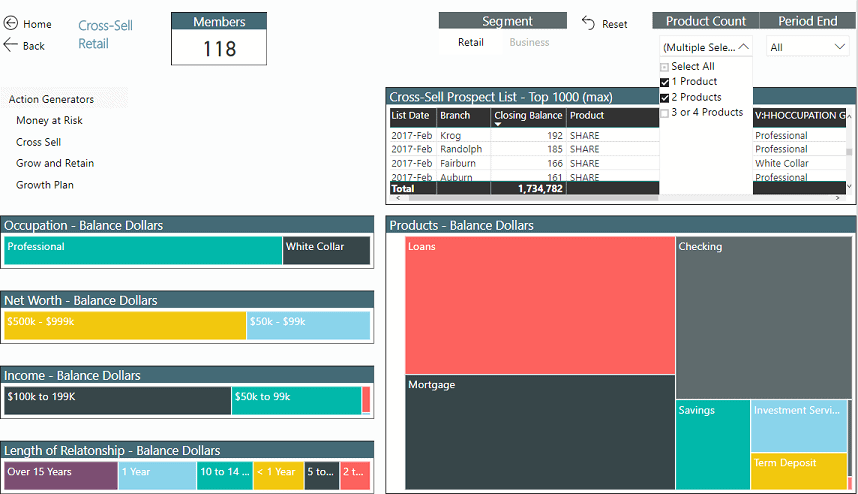

Start by identifying customers whose product holdings do not correspond with that of other customers in their same segment. That information needs to be paired with insight into the banking behavior /preference of customers in the same market segment at the time. That insight gives you the ingredients to create a value proposition that is relevant to your target customer. And yes, we are suggesting that you use the information to proactively call and work to satisfy your customer’s financial needs rather than wait for the customer to show up!

One last aspect of this, there is no “I” in a team. So, information about these customers must be shared among all your delivery channels to ensure a coherent customer experience. Your call center, front-line teller, account service team – they are all part of the sales process; the more eyes were looking for opportunities, the better your chances are.

Focus on reducing deposit attrition.

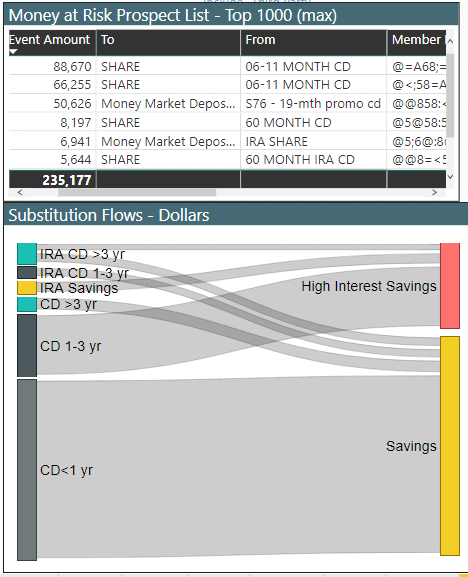

Deposit attrition in our industry is as pervasive as sugar is in food. We know it’s not good for us yet it’s in almost every relationship we serve. As a result, bankers seem almost resigned to live with it, and we struggle to properly measure it; never mind control it. I will start by agreeing that we cannot eliminate attrition. Some attrition is unavoidable in your portfolios: death, moving out of your market, these are things you can’t control. But we should not hide behind that uncontrollable part of attrition and remain complacent – there’s a big piece of attrition that can be controlled. Ask the average retail network management team for the growth targets for the year and you will get a straight answer. Ask them for the percentage of CDs they manage to recapture at maturity, or the attrition rate in Money Market accounts and anticipate a lengthy response.

BCG estimates 10-15% of gross revenue per year is lost to Attrition. But that is an industry average; do you know your number? In particular, do you know how much is true attrition net of product substitution? If you don’t, then how can you control it?

This problem is much more significant than bankers generally acknowledge, and it is because their focus is often primarily on customer or product counts. But, 80% of deposit dollar attrition occurs within continuing relationships. So instead of focusing solely on counting customers, measure the dollars leaving the bank, and even better, dollars at risk of leaving the bank.

Start by understanding your true attrition level and make the rest of the team aware. Awareness is the first step towards action – good or bad you need to know where you stand. Then set targets to reduce or maintain attrition at target levels. Ultimately, reducing attrition makes it easier for your network to achieve the portfolio growth targets, it’s a win-win for all. Always remember that the key to fighting attrition is understanding and satisfying customer needs. Meeting those needs will also lead to further cross-selling and up-selling opportunities that improve the customer LTV.